The cash back you earn for any month remains in your account as a future reward, as long as you make at least the minimum payment every month. When those purchases are paid off, you automatically receive the remaining 1% in cash back, for a total of 2%.

The only exceptions might be for purchases on which you own another card that pays a better rate on any particular purchase.Ĭharging purchases to the card earns you 1% in cash back. You’ll earn the most with the Citi Double cash card if you simply use it for every expense you can, from groceries to major household costs. Getting the most out of this card is pretty straightforward since there’s no need to worry about spending caps or rotating categories. That could take some cardholders a while-since you need to charge and pay off $1,250 to reach that rewards balance.Īlso, whereas rewards with many cards never expire, those with this card do, so if you don't earn cash back on purchases or payments for 12 months. However, with the Citi Double Cash, your rewards balance must reach at least $25 to request redemption. Competitors like the Capital One Quicksilver-which pays a lower 1.5% cash back rewards-allow you to redeem rewards for any amount at any time. Redeem cash back for a credit to your linked Citi checking or savings account, or to a checking account that you have used to pay your Citi credit card bill at least twiceĪ couple of minor caveats apply for redemptions, though, compared with some other cards.Redeem cash back balance for a statement credit.You only earn cash back on the balance shown on your Purchase Tracker.Ĭardholders have three main redemption options with this card: To help you keep track of the cash back rewards you're earning, Citi maintains a "Purchase Tracker" for your card account. The payment is due no later than the first day of your next billing cycle. You can make payments all at once or over time to earn cash back, but you must make at least the minimum payment on every bill in order to preserve the extra 1% in cash back. You then earn an additional 1% cash back when you make payment on those purchases. You get unlimited 1% cash back when you make a purchase. You'd then charge everything else to your Citi Double cash card.Ĭardholders can ultimately earn 2% cash back with this card. For example, you might pull out the American Express Blue Cash Preferred at supermarkets and to pay for streaming services, both of which earn 6% cash back, as well as for gas and transit purchases, which earn 3% cash back. You'd then pick and choose the most rewarding card by transaction. It's also a fine choice if you're a more motivated consumer who wants a highly rewarding default card to use with others that offer higher rewards on certain purchases. If you're not the type to master points schemes or register for quarterly bonus-rewards categories, this card's outstanding cash back earning rate offers effortless and dependable rewards on everyday spending. The Citi Double Cash credit card is most appealing to those searching for a no-fee card that's simple to use and earns excellent cash-back rewards. (Of course, as is customary, you'll also get dinged with a $41 late-payment fee and interest on your balance.) If you don't pay at least the minimum due on your card in any month, you'll lose the matching 1% in cash back that's paid after payment is received. Miss a payment, lose half the cash back: This is not an ideal rewards card if you occasionally skip a payment, whether due to a memory lapse or tight finances.True, the typical bonus for a cash-back card tends to be lower than those for other card types, but it's still substantial, generally ranging from $150 to $250. No one-time offer: Most competing cards provide a cash one-time offer, but the Citi Double Cash offers none.After the 0% introductory period, the variable APR varies with a normal range of 18.99% to 28.99%. Not uncommonly, there's a fee of $5 or 3% of the amount of the transfer, whichever is greater. You get a 0% APR for the first 18 billing cycles, which is a longer period than many such offers. Generous intro APR on balance transfers: This card has an attractive introductory offer if you're transferring a balance from another card or cards within your first four months with the card.Competing cards with a flat rate on all purchases pay just 1.5% in cash back. That rate is hard to beat, especially for a card with no annual fee.

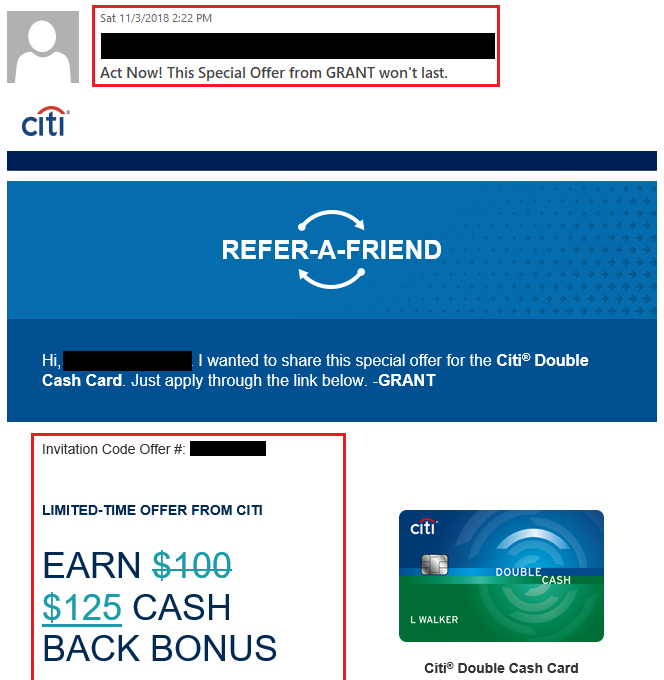

CITI DOUBLE CASH TRANSACTION FEE PLUS

0 kommentar(er)

0 kommentar(er)